The Right Move

We help you make the right property moves

UNBIASED INSIGHTS

DATA BACKED

REAL ESTATE ANALYSIS

Alvin Chin

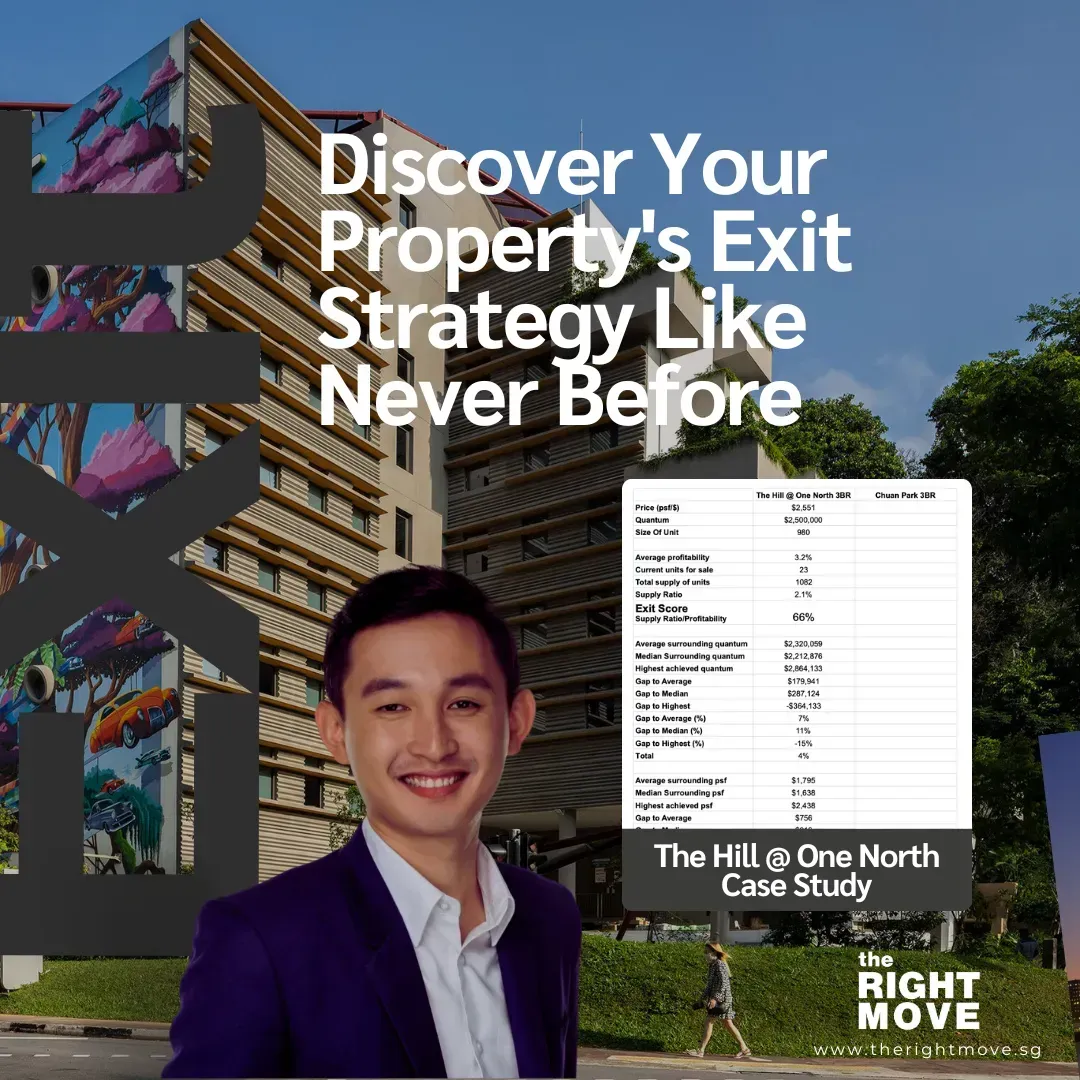

Alvin Chin is an experienced real estate consultant specializing in detailed, data-driven property analysis. With extensive industry knowledge and expertise, he offers a unique combination of insights, integrity, and personalized service to his clients.

He primarily serves high-income professionals from the banking, finance, engineering, and technology sectors, typically in their mid-30s and above.

Recently, Alvin compiled his in-depth real estate research and practical toolkits into a series of easy-to-digest PDFs, designed to help investors make more informed, confident property decisions.

AVAIL OUR FREE RESOURCES!

Testimonial

you’re in good company!

Watch our YouTube Videos!

WE CAN HELP YOU!

Now that you've gained insights into the upcoming trends, are there any specific areas you'd like further assistance with in preparing for potential shifts in the real estate market?

If you're looking to take the next step, consider booking a free consultation with me. I'd be happy to delve deeper into how you can effectively incorporate the research findings into your decision-making process for the best property outcomes.

Feel free to reach out to schedule your consultation. I look forward to assisting you further.

Let’s plan your move?