Today’s topic is Cooling Measures. Potential cooling measures are one of the biggest topics that anyone with a passing interest in property and real estate would be discussing.

If you want to get into the property market, you need to know about this. Potential measures, their effects on you, how they change the market and when they are implemented are all important question you must know to profit.

Recent News

Before we talk about cooling measures, we would like to highlight points of learning and discussion from the recent news so that you are kept in the know.

Firstly, there was an article was published recently on the most recent GLS in Farrer Park being sold to CDL and MLC. There are a few details in this article that we would like to discuss as they stand out to us.

The plot transacted at $1129.38 psf per plot ratio where the estimates clocked the sale price at $1800-2000 psf, depending on which analyst you refer to. These estimates might seem like an expensive price, because $1800-$2000 psf is not a cheap price at all. However, if we look at the per square feet of the land sold nearby, Uptown at Farrer which was transacted at $1000 psf per plot ratio 4 years ago, that represents a 12.5% premium over the plot previously. Based on what we know, plots that are moved or sold from a previous cycle to a new cycle easily rise in price a good 20%. This means that the 12.5% premium is not as significant compared to this.

Furthermore, we see 10 bidders for the site. For those that have followed our content, the number of bidders in a GLS is a factor that we consider. This is lower than the Tanah Merah site bidders which was 15 and significantly lower than the previous batch’s last plot, the Daintree Residences, which had 24 bidders. This is significant, especially to our topic of interest which we will discuss later.

Another interesting point to note is that it was awarded to a joint venture between CDL and MCL. CDL and MCL are both very large developers, so it’s strange that they go into a joint venture to bid for a piece of land. We predict that this will be a trend that we will see more and more of as we move forward. The developers are being smart and noticing the cooling measures weighing them down, so they choose to hedge out their risks to bid for more plots and go for more opportunities when they come. They go for joint ventures and spread out their risk, which is a smart move on their part.

Next, we will be talking about the changes in the Q1 private property price index, which jumped 3.3%, larger than the URA flash estimates for Q1.

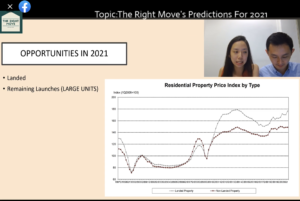

Their estimates released earlier in the year during February-March, predicted 2.9%. This difference is what has created the current conversation on cooling measures. On this topic, we can focus on a specific part of this article, where landed properties have had their prices increase 6.7%, one of the larger jumps which also contributed strongly to the 3.3% increase. If you recall one of the videos we did this year, where we talked about opportunities in 2021, we did identify that the price of landed properties was poised to outperform estimates in 2021.

If you want to understand and identify the other opportunities that we predicted, do look at that video, titled “The Right Move’s Predictions for 2021”.

Another point from this article which we felt was really important, was the section on resale volumes. It claimed that resale volumes were picking up where resale contributed to more than half of private property transactions. This is a large change from one or two quarters ago, where most of these transactions were contributed by the sale of new launches. This snippet can be unpacked to understand this trend and the market.

Some people may ask, “New launch price so high, are you sure can make money? If everyone buys new launches, then who buy resale?” The truth is that the demand for new launches will always be high because people like new and shiny things. How the markets work and remain sustainable is through the cyclical nature of demand. The price gap between launch and resale is narrow and people tend to go for new launches because of this and the variety of choices available.

People always look towards purchasing new launches, but as supply for new developments drop, developers raise the prices and the cheaper new launches get sold, buyers have no choice but to turn to the resale market. When the resale owners notice the sudden increase in viewings and read the articles in the newspapers, they increase their prices, which is in fact what we are seeing today. This is how the demand cycles between resale and new launches.

History Of Cooling Measures

Let us go into the actual topic for today, the cooling measures. We always like to explain topics to our followers by bringing in some history, to show what has happened before and what is happening currently to predict what will happen in the future. We will do a bit of a dive into the history of the cooling measures.

A lot of us remember cooling measures from 2013 and 2018, but they have been around for the longest time. The first cooling measures came up in 1996, right before the Asian financial crisis. In 1996, they introduced loan to value and first started to introduce Buyer’s Stamp Duty (BSD) and Seller’s Stamp Duty (SSD). They took these out a couple of years later to help prop up prices, but cooling measures are nothing new to the market.

If we look at this timeline, the red dots represent cooling measures and the green dots represent reversal of cooling measures or pumping up of supply to prop up prices. The blue line, of course, represents the trends of the property price index. What we see here is quite clear, every time the prices shoot up, the government uses cooling measures to try to bring prices down.

The more interesting thing to note, however, is that when the prices drop, the government has the habit of reversing cooling measures or pumping out supply to prop up prices. A fun fact about this timeline, is that Singapore used to have capital gains tax, introduced in 1996, but took it out in 2001 when they wanted to prop out the property prices after the 2000’s dot com crash.

During the Covid-19 pandemic, the government did not need to implement any measures to prop up the prices, as we saw they did with the green dots in every other crisis situation. This goes to show how the market has matured over the years and how the demand has shifted from extremely speculative, as seen in the huge ups and downs in 2013, to a more organic demand, as represented by the smaller jumps in prices today.

2018 Cooling Measures

Focusing on 2018, we want to take a closer look at the cooling measures of that year. In the quarters directly preceding the July 2018 cooling measures, the property price index rose 8.3%, which resulted in the cooling measures being put in place.

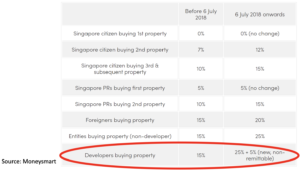

This created two consecutive quarters of downward movement, totaling just -0.7% before the market rose 1.5% in the second quarter of 2019. There were a lot of complaints about how the LTV was dropped and everything shifted by 5%. Also, ABSD rose by 5% and LTE dropped by 5%.

What a lot of people do not know is that the main group that was severely hit by the cooling measures are actually the developers. While most of us were affected by up to 5% but the developers were negatively impacted close to 100%.

Their ABSD doubled from 15% before 2018 to 30% after July 2018. The group that gains the most is the government, but also yourselves, as we are going to share how to use the knowledge of the cooling measures to our advantage.

Why did the prices not drop after the last cooling measures? Very simply put, the market has gotten used to cooling measures. Previously, things like TDS and ABSD were entirely new concepts to the market, and no one knew how it would affect them. This meant that the market would take a few years to get used to it. Furthermore, people assumed this would be temporary and wanted to wait for the measures to be taken out. Now, most of us would expect new changed measures rather than hope for previous measures to be removed. The market has gotten used to the cooling measures and are thus not surprised by them anymore. With new measures being introduced, people just took a step back and prices did not drop too much as they came back onto the market very quickly.

Another reason why the measures did not cause a significant price drop is that the measures were primarily targeted at getting developers to settle down and not go overboard in the en bloc market.

Ultimately, what we learned from this is that the strong underlying demand of the market replaced the speculative demand after the 2013 cooling measures. Post-2013, the market is driven by organic demand from upgraders or local investors. Things like SSD and ABSD make it difficult to quickly flip property these days. This has created a significant degree of stability within the market, which why the prices never really dropped during the Covid-19 pandemic period.

Hidden Cooling Measures

Another thing we might not be aware of are “hidden” cooling measures. These are not publicised as cooling measures, as they are targeted at specific groups of people rather than the entire market as a whole.

The first of these would be the banning of reissuance of option in September 2020. Not many of you would have heard of this unless you were looking to buy a new launch. Before this ban, developers were giving upgraders the option to put down a deposit and take the time to sell their current properties before they actually purchased the new launch. This created a lot of artificial demand as it caused a significant spike in the sales volume. The government wanted to normalise this data to make it more accurate to the current situation and banned the reissuance of options to help with that. This affects mainly developers and upgraders but has had significant impacts on the market, causing volumes to drop off quite a bit.

Another “hidden” cooling measure would be the minimum average size requirement, something that we have identified as having impacted the market significantly. In fact, this might impact you much more than timing the cooling measures, as all the units and land sold after this requirement was introduced are limited to an 85 m2 unit size.

What this means is that the units will get bigger on average, as will quantums, which also means that the units becoming more expensive and harder to afford. As the supply for the new launches before the requirement will be bought very quickly, the new batch of properties will be larger in size and quantum but also harder to afford.

Where Are We Today & When Will It Happen?

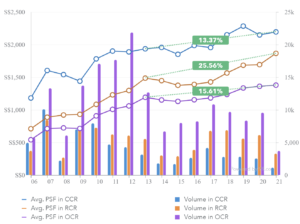

Where are we today? Well, prices have come up 6.5% over the last four quarters, but still a way off from the previous benchmark of 8.3%. In Q2 we expect the price to continue to jump up as we anticipate a lot of high-quantum and psf properties, like Irwell Hill and One-North, that are close to $2000 psf, which inevitably will drive the prices up.

Based on this, what will happen next? What is the government looking at when they determine whether to implement the cooling measures? There are a few factors other than the Property Price Index that we must think about as well.

Firstly, the speed of the PPI increase. The increase in PPI is expected and planned for by the government, so they will only bring in cooling measures if the increase in PPI is sudden and more than estimated.

Secondly, the interest rates are also important for us to look at. The government keep a check on interest rates and if interest rates do come up, they naturally lower demand and activity in the market, so the government does not have to step in with cooling measures. Since the government does not control interest rates, this is a factor that they will look at to decide what to do next.

Thirdly, the economic and Covid-19 outlook. The big news these days is that the Indian government is closing their borders and we can expect delays in construction. This will be something that impacts supply and in Singapore right now, supply is getting rather low.

We can use the analogy of a spring to explain how the market’s demand works. In the last few quarters, low interest rates, low supply and pent-up demand has resulted in a loading up of the spring and compressing it down. There is thus a high risk of it violently bouncing up, sending the prices shooting up. The government does not want to implement cooling measures right now, as that would load the spring even more and risk even higher prices in the future.

If there was a sudden factor that caused the spring to spring up after they loaded it, their normal measures would be insufficient, and they would have to implement extremely strict, draconian measures to even have a means to affect the large change in demand.

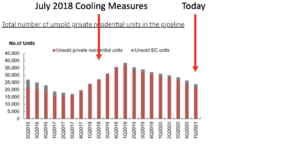

There is a significant difference between the situation in 2018 and where we are today. The 2018 cooling measures came about from the uptrend of supply, where developers did a lot of en bloc. The government was worried if the supply would be too much for the demand, especially since their minimum size requirement makes them more expensive to purchase. They did not want the oversupply to spill over to other markets, so they put in place the 2018 cooling measures to control this supply.

Today, when we look at data, we see that supply is actually coming downwards, not upwards. Therefore, we personally feel that the cooling measures might not come yet. The dwindling supply and the drop in construction would make any cooling measures a little pointless and could load the spring even more. Even if cooling measures were to drop, we believe that prices will not drop.

Potential Cooling Measures

If the government were to consider cooling measures, we have identified a few that might come into the market.

- Tightening TDSR which affects loan quantums, would technically hit everyone but, not as much as you would believe. For those that have done your IPA, you would have no issues with the loan quantum, rather the down payment is the biggest issue for most people. By tweaking this, it sends out a message to the market and prevents over-leveraging. The chance of this happening is quite high, as it does not affect the majority of people’s ability to purchase but still drives a shock into the market to slow down purchasing.

- They could also shorten loan tenure. The current loan tenure for private property is 30 years and if they were to drop it down to 25 years, that’s going to increase repayments. This acts like an increase in interest rates, as your repayments would jump significantly. This measure would affect everyone, and we estimate the probability of it happening as medium.

- Lowering LTV would incur higher down payments which affects everyone in the market. However, the likelihood of it happening is low to medium because it would affect first timers a lot and the government would not want to hurt this group too much. If you analyze real estate markets, you will actually see that lowering LTV is the preferred method for cooling down markets across Asia. Lowering LTV also encourages lesser leverage.

- Raising ABSD is a measure that has a very low likelihood of happening as the current ABSD is already a lot for most people to handle. Any increase would have a marginal impact on the market, and it affects a marginal group of buyers which is why we do not believe it will be implemented.

- Raising Buyer’s Stamp Duty is another cooling measure that could be implemented. As there’s still a large volume of 1-2 million dollars transactions, implementing this for those price ranges would serve as a wealth tax. We rate the probability for this being implemented for the high price ranges as medium, but low across the entire market.

- Capital Gains Tax serves as sort of a wealth tax. It has a low chance of being implemented as the scope of its impact is low, given that it mostly affects investors.

- Increasing Seller’s Stamp Duty and increasing MOP would both create longer holding periods. Increasing SSD has a very low chance of actually happening as it really only affects investors. Increasing MOP will create a lot of unhappiness in the market as it forces HDB owners to stay in their HDBs for a longer time. This would, however, also give the government time to increase supply in the private property market, as the HDB upgrader demand would be very strong in the next few years. If there’s not enough supply to feed this demand, the prices will shoot up significantly. While this policy will be very unpopular, logically it makes sense to be implemented, which is why we believe the likelihood of it happening is low to medium.

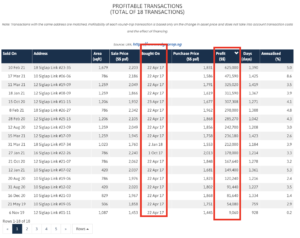

Is it worthwhile to time the cooling measures? This is the most important question that all of us need to answer. We have a few examples of people that bought before and after cooling measures to directly show you the impact.

Seaside Residences was launched in 2017 when prices were in an uptrend. They were sold at close to $1600-1800 psf which at the time was very expensive. The Seaside Residences, located at Siglap, were considered OCR and that price for OCR at that time was very high. Recently, we have seen the profits from sales of these units, and they are very good. These were bought way before the cooling measures and then sold after the cooling measures when the supply was low, and prices were higher. The last time the government implemented cooling measures on July 5th, 2018, the market went crazy.

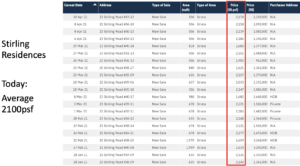

As they decided to have the rule change at 2359hrs on July 5th, there was a scramble to purchase nationwide. Usually, the common understanding is that when everyone is rushing to buy, it’s good to take a step back. However, if we consider the Stirling Residences, we may see that this was not the case for this particular situation.

The Stirling residences were released on 5th July, the day the measures were to be implemented, at $1800 psf. Today, most recent sales average at $2100 psf, showing a $300 psf increment already since July 2018.

The market has already gotten used to the cooling measures, so prices will not really be affected if cooling measures come in. So, what should you do?

If you are an investor, ABSD is unlikely to change and so there’s no real urgency especially if you are sitting on a lot of cash. Even if TDSR or LTV comes up, it will not really affect you much. That said, supply dropping will not help you much either. If you do wait, it’s for more options, not a drop in prices.

If you are an upgrader, you should watch out for HDB price trends, especially the supply-demand dynamics affecting the HDB and private market, rather than timing cooling measures.

For first-time buyers, there’s even less impact from cooling measures on you, as supply is coming down and quantums are coming up. Waiting too much will be bad for you, as private property prices will grow increasingly unaffordable for you. Even if they do remain the same, if the stamp duties are increased, or drop the LTV and TDSR, it will be way harder to buy. If you are a first timer, you should not worry about the cooling measures or waiting to buy.

If you think about it, buying on either side of the cooling measures doesn’t really matter if you buy the correct property, you have holding power and know when to exit the market. The market has gotten used to the cooling measures and even if they come in, will recover very soon. Cooling measures serve to shift the demand, not destroy it entirely. Prices will inevitably recover, or might not drop at all, given that the supply is falling. Focus on spotting fundamentally right properties with good locations and amenities and focus on affordability. Review the cooling measures we listed earlier and think about how they might affect you. If none of them will significantly affect you, you have time to make a decision. If they significantly affect your buying power, then rework your whole timetable rather than thinking about timing cooling measures.

How To Make ABSD Work in Your Favour

Here’s a bonus for you! We are going to discuss how to make ABSD work in your favour. Singapore was one of the first countries to implement cooling measures, as we started in 2013. We were one of the first countries to implement ABSD on foreigners.

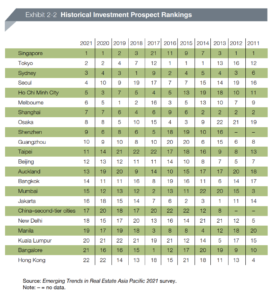

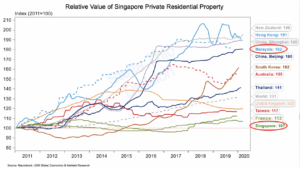

If we look at data, we see that other countries did the same 3 years later, after the prices had shot up significantly. If we look at the PWC Emerging Trends in Real Estate in Asia-Pacific 2021, Singapore starts off as a popular and desired market for real estate from 2011-2012, but our ranking start to drop from then onwards. We go from first place to double digits in a few years, and this is all because of the cooling measures.

The cooling measures raised the prices in Singapore, making foreign investors unwilling to enter the market as well as causing them to shift their investments elsewhere.

The cooling measures coincides with the underperformance of CCR when we look at the data, especially compared to RCR as well as OCR.

Once the other countries start to implement all these measures however, we see that the investments and funds start to come back to Singapore, owing to its relatively stable and safe status as an investment location.

This results in the CCR performance picking up in recent times, like the sale of the Hilltop Penthouse and other such properties. For foreign investors with a large net worth, stability and safety is the most important factor they consider. From data, we see that they choose quality assets regardless of price and location. As the Hong Kong situation continues to be uncertain and risky, Singapore will benefit with more attention and investments.

So, in order to take advantage of these cooling measures, as a Singaporean or PR investor, look out for properties with a high foreign resident percentage. The foreign residents will be paying 25% ABSD, much higher than the 12% of the Singaporean and 5% of the PR. Your profit margin will be much larger than that of the foreign residents and thus your prices can be more competitive and give you a strong advantage. This is the secret to making ABSD work for you!