In today’s article, we’ll be sharing our property portfolio, which showcases what we did in the past, what we have at the present and what we intend to do in the future. Rather than just simply telling what we have, we want to share the whole top process, the mindset behind our portfolio planning and investment journey. Because we usually focus a lot on research data, facts and figures, the logical aspect of real estate management in our channel, we will focus on what we feel is very much lacking in the sharing we have already done before, which is the mindset to our decision-making and advice. The mindset of real estate and property purchases are incredibly important in our current times, with the market moving at such a fast pace, and with people really not knowing what exactly is happening in the market.

Recent News

Pasir Ris 8

As usual, we will start with the recent news. So, in the most recent news, the one that’s got everybody shocked, even us, is the Pasir Ris 8 launch over the weekend. While we wouldn’t say we were surprised by the 85 percent take-up rate, what surprised us was the eventual PSF ([dollars] per square foot) that was reached at that development at $2000 PSF. This $2,000 PSF was not for a 1 bedroom but rather it was for a 2 bedroom.

If you read the article above, there was a two-bedroom apartment that was transacted at $1.5 million. So that is a 700 square feet 2-bedroom property, in Pasir Ris, that was transacted at 1.5 million. For us in the market who have seen the high PSF, it was honestly quite a shock to us as well. While we didn’t exactly predict it hitting the $2000 PSF, we did predict that this is how aggressively the developers could have been or would have been. You can see this in a video done earlier this year about the three things we liked and did not like about Pasir Ris 8.

One of the very first things that we highlighted was that we did not like the timing of the launch because the market is moving so quickly now, developer stock is falling so quickly, there are not many options and huge pent-up demand. All these reasons mean that the ball really is in the developers’ court, to do what they want to do. We’ve also seen comments on Facebook, or things like people posting on his own Facebook page, about how they queued up for two hours. They went down in the morning expecting to pay $1.1-1.2 million for the two-bedroom unit and then ended up having to pay $1.5 million for it later on in the evening, with the developers raising the price is 6 times during the launch. This is something that is not new to the market. While the $2000 PSF for Pasir Ris is indeed new, that amount for the market is not something that is new. If you want to see what else we predicted, how accurate our predictions for Pasir Ris were, you could check out our video, which has been linked above.

On the topic of accurate predictions, do also check out how accurate our predictions are for the launch at Bartley Vue. It’s in the same format as our Pasir Ris 8 video and we also have videos for One-North Eden and Normanton Park for you to check out if you want to see what to expect from in the future.

Twin VEW

Next, when I said that developers being aggressive and high take-up rates during a launch wasn’t new, it’s because we’ve seen it all before just three years before at Twin VEW. Scarily enough, the take-up rate was exactly the same at 85 percent. We’ve also noticed what some of the analysts have been saying and it sounds very, very similar.

Over at Twin VEW, CDL (City Development Limited) bought the plot, which is today’s Whistler Grand, at a much higher PSF. People are taking those future PSFS as reference for existing launchers and the value in existing launches. We are going to touch on that later on as well.

Déjà vu

To reiterate there is an uncanny resemblance between these two events, with 85 percent and 85 percent, just three years apart. The similarities in what is happening in the market today doesn’t stop there as we can see with the next bit of news, where the private home supply from confirmed sales sites rose 25 percent. We get a sense of déjà vu again and this was highlighted in the June Facebook Live about how the government is noticing what is happening in the market and noticing that the supply is not enough, which is why they are increasing the supply.

I had clients coming to me and being quite concerned that the land supply was rising up. In basic economics, if there is a high supply and the demand is not high enough, the prices will start dropping. This might not necessarily be a cause for concern, as if you really go and look at the data, this increase is nowhere near enough.

I had clients coming to me and being quite concerned that the land supply was rising up. In basic economics, if there is a high supply and the demand is not high enough, the prices will start dropping. This might not necessarily be a cause for concern, as if you really go and look at the data, this increase is nowhere near enough.

For those who are new to our content, we often use supply factors to forecast the market. Why? Because supply, especially in real estate, is often very inelastic. You cannot suddenly increase supply and have houses appear out of nowhere. You have to sell the land today, to feed the demand three to four years later.

The huge challenge the government is facing today is with the Covid-19 pandemic making everything so uncertain, they do not know when they can expect the supply to come into the market, even if they put out the land today. Over at HDB, they are forecasting it to take 6 to 7 years to get the supply on the market, which is creating a lot of uncertainty in the market and it’s making it very challenging for the regulators to try to manage. Even without Covid-19, they have had trouble managing the whole supply as we can see later, in an example case study. The government just cannot seem to get the whole supply situation right and this creates gaps in the market for those who know how to analyse it. For those of you that follow us on a consistent basis, you know how much we love to analyse supply charts and the gaps we spot by doing this. Later on, we will explain and show you the that we use in our own portfolio planning.

We also cannot talk about déjà vu, mentioning the similarities in what is happening in the market, without addressing the elephant in the room. This is the previous 2016, 2017, 2018 cycle finished with the property cooling measures implemented on 5th July 2018, resulting in the rush that we have seen in the news. We have actually elaborated in detail about what we think about the cooling measures and how we felt it was going to affect the market, so if you want to understand cooling measures and our thoughts about them, take a look at our Cooling Measures Video. It’s going to be a lot more relevant today than when we did it in May.

The question that everybody will be asking us, for sure, is what do we think is going to happen? Do we think to expect there to be cooling measures? I’m going to go out on a limb, based on the information that we have today, and I’m putting out my prediction at a 60/40 split with 60 percent being “No” and 40 percent being “Yes”. I’m leaning more towards a “No” because of the significant difference in supply today versus where it was in 2018. In 2018 when the cooling measures came, there was a huge amount of supply coming onto the market due to the en bloc sales, so the prices were shooting up as well a huge rise in supply coming on the market.

The developers also took advantage of the market being very hot and began pushing the prices up significantly. But today there isn’t a lot of upcoming supply available. Even though the government has increased the supply by 25 percent, as you have seen in the previous article, in our opinion, it’s not enough and we are also almost finished with the developers’ existing stock, which has dipped below the 20,000-unit mark. This number served as the marker the last time in 2016 when the developers’ stock dipped below 20,000, it kickstarted the entire en bloc rush. Today, however, we have dipped below it and the developers are still quite conservative and not daring to enter the en bloc market. It is key for us to remember why the government implements cooling measures. They do so to avoid a huge swing in prices. They don’t want prices to go up very quickly and then drop back down very quickly afterwards. These measures are intended to prevent swings and are not intended to cause these swings. It is not the government’s intention to crash the market. In 2018, they were afraid of the huge incoming supply.

If, the price shot up significantly, out of the reach of the average Singaporeans, or if it shoots up too quickly and the developers could not clear their stock, they start cutting prices. This means that the price chart will show the prices going up significantly and dropping significantly and at the end of the day, that is going to put the consumers and buyers at risk. Today, there is no fear of that over-supply coming onto the market.

As a matter of fact, there is going to be a lack of supply in the market. You might argue that the government would try to implement a cooling measure to hold back the demand while supply slowly comes back onto the market. However, this is a very tricky thing for the government to do, as if the pent-up demand floods back even stronger, later on, there’s still going to be a huge swing.

Like what I mentioned earlier, the government is in a conundrum at this point in time. The analogy we would use is it is like a spring. With COVID delays forcing demand to rise combined with a lack of supply, squeezing the spring downwards. A huge number of HDB MOPs (Minimum Occupation Period), again squeezes that same spring. So, this spring is now severely compressed. If another cooling measure were to come online, that’s going to squeeze the spring even more, because as we said earlier in this article, cooling measures are meant to put a pause on demand but not necessarily to remove demand from the market. It did remove demand from the market in 2013, when the ABSD (Additional Buyer’s Stamp Duties) and TDSR (Total Debt Servicing Ratio) caused speculators to exit from the market, but today there are few speculators left in the market. If you ask us whether new cooling measures will destroy demand, our answer is “No”. it puts a pause on demand instead.

Before we move on, if worrying about cooling measures are the single, biggest thing weighing on your mind and holding you back from a purchase, then I would say you are not planning your purchase right. So, when planning is done correctly, and this is something that we tell our clients, if you buy today and cooling measures come tomorrow, and you think that you will be very stressed out or will lose sleep over it, then you aren’t ready to buy. You haven’t done sufficient planning to buy, and if you have, if you buy today and the cooling measures come tomorrow, you shouldn’t be worried at all. In that case, you have done your planning right. So how do you do it the right way? Stick with us and we will get to that.

New Land Sales

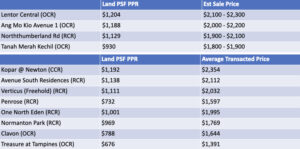

The next big piece of news is about the new land sales. We believe that this was the precursor that led to the whole Pasir Ris 8 situation as people saw what the estimated sale prices would be like for the new supply. So, what do I mean by new and old supply? I’ll share with you more as we go along and then you will understand a little bit more. The Lentor side was sold basically last week.

Basically, Lentor OCR (Outside Central Region) is going to have to sell in excess of $21,000 PSF. Tampines EC (Executive Condominium) is going to have to sell in excess of $1,200 PSF, and this is with land costs and with developer break-even costs and profit already factored inside, just two years back, what could you have bought this similar type of properties for?

Let’s take a look. We have a chart here which shows the recent land sales. Lentor Central is at 1204 PSF per plot ratio. I’m going to bring your attention to the very last line, about the Treasure at Tampines which was launched two years. The land was bought 2-3 years ago, and the cost was 676 PSF per plot ratio. So, it has basically doubled because it is in the OCR. Clavon is also in the OCR and that was at $788 PSF just about 1 and 1/2 years back. It’s almost like the average transacted PSF has just a hundred $190 PSF difference between the land costs over at Lentor Central and it and people are starting to realize this.

This is why the demand is flocking back into the previous batch of supply that we see. That’s what you see if you compare these two plots. If You want to compare further, you can also compare the fact that for Lentor Central at 1,204 PSF per plot ratio, the land cost is even higher than that of Kopar at Newton, which is in the CCR (Core Central Region), so this is OCR versus CCR. The land cost is basically the same, so future supply, the future benchmark prices have been set and that is where we are headed to.

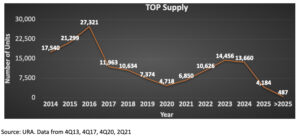

Let us use this chart to illustrate the progression of land costs. We have seen the upcoming supply and the upcoming supply for Lentor will be basically outside of the number ranges in the graph that we see over here, after 2025. If you look at the graph, it went up in 2014, 2015 and 2016 and it came down for a period of time. Then it started to rise again in 2022, 2023 and 2024 before falling again and so will eventually come up again in 2026, 2027 and 2028. Once the manpower shortage is filled up and Covid-19 is over, the government will ramp up supply again. Supply charts tend to always look like this one, where it’s always going up and coming down, going up and coming down. In the previous peak in supply during 2014, 2015 and 2016, just for your reference, we picked out Parc Vera, which is in Hougang, to take a look.

The land costs for park Vera, on the left side of the graph, is at $339 PSF per plot ratio. So that was the first peak on the extreme left that we could see. In the second peak, at 2022,20223 and 2024. We use Treasure at Tampines because it’s going to TOP (Temporary Occupation Permit) in 2022-2023, and the land cost was $678 PSF. We went from 339 PSF in the previous peak to 676 PSF. The current peak and the future peak, Lentor, that we saw was $1200 PSF, so it’s quite scary in the sense that it’s basically doubling from $300 to $600 then $600 to $1200 PSF. Every time supply gets absorbed up when the new supply comes on the market, it is always at the new price. And once this new supply gets absorbed up, the future supply will be at the new price.

For all of you who are listening out in the market looking to buy, you shouldn’t be too concerned with the cooling measures, because if you wait and they don’t come, the new supply is going to be a lot more expensive. All these external factors, fear and/or doubt in the market, with the market moving so quickly, is inevitably going to result in a lot of stress. We are actually speaking to quite a few clients at this point, who are feeling very stressed because the market is moving so quickly. Everyone can see what the future prices are, as that has already been established. When the first land sale came out at Tanah Merah, we predicted this happening already, but people didn’t really quite wrap their heads around the concept yet.

We have Ang Mo Kio and Lentor coming up, back-to-back, and then we have Jalan Anak Bukit coming up real soon to follow. People are starting to accept that these are going to be the new benchmark prices set and that’s causing a lot of stress. Stress and fear come from a lack of knowledge and a lack of a clear plan. So, let me very quickly summarise why this is happening, such that you can understand and start to create your own plans.

In the macro-perspective, macro here referring to outside of Singapore, in the whole world, interest rates are very low, which coupled with high money supply will result in asset prices inevitably coming up. These are very standard economic fundamentals.

Low interest rate, high money supply means that asset prices definitely will come up. “Isn’t it a bubble?”, you may ask. Well, personally we feel we are not in a bubble and, coming back into Singapore, this is because we have all the cooling measures in place. We have ABSD and TDSR to keep the market sustainable, to remove speculation from the market and to remove over-leverage in the market.

As opposed to previous sharp rises in prices like the one we’ve seen pre-2013, the market is in a much better, much more sustainable place today. We also have a lot more savings today where the overall Singapore household balance sheet is in the net cash position versus pre-2013 where it was in the net debt position. So further looking within Singapore, something we’ve seen in the population census data, is that there’s a higher preference for private properties, and it’s been the trend over the past couple of censuses done.

There’s higher earning power where 13.9 percent of the population are now earning a combined household income of more than $20,000, a sharp increase from the previous census done just 10 years back where the biggest group was made up of people earning a combined household income of just $3-5000. It has jumped to 4 times that amount in 10 years, all the way to $20,000. They also start coming out of their HDB MOPs because there’s a huge supply of HDB MOPs over the last couple of years and for the foreseeable future, as the government had pumped out a lot of HDB supply post-2011.

All this reminds us of gunpowder in the market at this point in time. Huge savings, huge earning power, huge profits from their HDB, all ready to take action into the market.

To summarise, is this predictable? We have predicted this to be happening a while back and if you have followed us for some time, you know that we have mentioned it over and over. Is it scary?

It probably is, but the reason it is scary is because of a lack of knowledge and the lack of a clear plan. Don’t be scared. We wanted to create this article not just to tell you how to plan, but also to share with you how we did it as a case study.

How Do We Plan?

For those of you who follow us, you know that we have very deep know-how of the market. We love to use past data, as well as what’s happening currently in the market, to forecast what’s going to happen in the future. In our content, we use a lot of the supply chart, and the supply chart is very powerful because it’s very easy to predict the supply in one to three years’ time and it cannot change much. This gives you certainty in your predictions of what’s going to happen in the market. We do this, not just because it’s part of our jobs, but also because we have a passion for it. We are invested in it because we are also in the market.

Having good knowledge of the market reduces and dispels fear, so you are doing a good job by joining us and gaining knowledge. Hopefully with more knowledge, the fear factor drops as you have more clarity of the future. So having deep know-how will allow you to be able to spot patterns and gaps in the market, like what we showed you in the TOP supply chart. If you have this deep, understand and you can spot patterns like that, it gives you that edge.

When you know you have a certain edge in something, it also gives you confidence to make a higher purchase or in making that little leap of faith when you know something that other people don’t. We have consolidated that into an e-book and so if you drop us a text, we will immediately send it over to you.

The next thing that we do, is to map out our long-term goals in in terms of our property, so that gives us great clarity because we know year-to-year what we need to make sure that we are on track, which year we need to sell and which year we need to buy. Based on the year we expect to buy, we also can find out what the forecasted price is so that we know how much we need to prepare for that particular purchase and that makes things very clear.

It makes the goals very objective. So then of course, one of the last things that we do which is also very important, is to have a contingency plan. And this is all the more important today because nobody knows what’s going to happen on a month-to-month basis. The whole this whole COVID-19 situation has made the need for a contingency plan all the more important.

The Execution

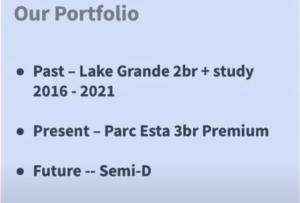

Let me now share with you the execution of our plans. OK, so this is our portfolio. We bought our lake Grande which is located in between the Lakeside and Chinese Gardens MRT stations. We have never stayed there single night in our lives, through the period that we owned it. So, we are not terribly sure about the location, and it was a pure investment that we bought in 2016.

We sold it late last year and it completed earlier this year. It was a 2-bedroom plus study. Later on, I will share with you the numbers behind it and some of the learning points that we learned from the purchase, on top of what we do day-to-day as agents which was one of the big reasons why we decided to do this sharing. While there’s a lot of things that we learn as agents, there’s also a lot of things we learned in our own sales and purchases, so we want to merge that together to give our readers more information.

What we do own currently is a Parc Esta 3-bedroom premium and later on, we will share the whole thought process that we went through to plan for that purchase and what we hope to achieve in the future. The long-term goal that we have is to purchase a landed property.

Our Property Plan: The Past

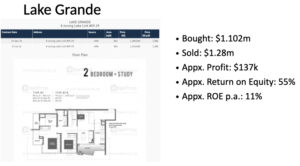

So, this is the actual unit at Lake Grant we purchased, #09-29. We like to have full transparency and you can check this up in whichever viable public portals that that that you have available to you. We bought it in 2016 at $1.02 million.

Here’s a bit of funny backstory. We told our parents that we were looking to buy a lakeside property, a property in Jurong when we stayed in the east. The purchase being a 2-bedroom plus study at $1.102 PSF, meant that the reactions that we got from our parents was a lot of shock and a lot of bewilderment. They said, “why do you want to buy that? And isn’t it crazy expensive?” This was in 2016, when there was still quite a lot of uncertainty in the market. The market was nowhere near what it is like today, but we did our research.

We bought into the whole Jurong-Lakeside transformation and the high-speed rail which got cancelled, but thankfully the investment still turned out pretty well. We will share some of the things that helped make it a good investment despite the cancellation of the high-speed rail later. We bought it at $1.02 million and sold it at $1.28 million. It will look like a profit of $180,000 but if we consider the stamp duties and the agent fee and the approximate net profit was $137,000. To calculate return on equity, divide the profit by the capital that pumped in, which we put in about $250,000, including the 20 percent down payment and also the stamp duty payments, which money out of pocket.

Return on equity would, simply put, be money that you collect versus money out from pocket. Based on our calculations, that gives you approximate return on equity of 55 percent over 5 years and that works out to 11 percent per annum, which is not too bad. While Elizabeth thought that if we have kept it a little bit longer, we could have made a lot more, but again we can’t really have predicted how it would have turned out, so we are still pretty happy with what we got.

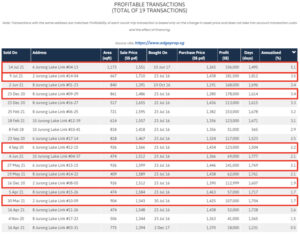

Before we move onto our next property, what I thought would be interesting to share is some of the current data and what could we learn from the current data, and we have highlighted the transactions that we felt was most interesting. The unit that makes the most money is a 4-bedroom, 1172 square feet. This was bought at $1265 PSF and sold at $1551 PSF. We sold it at $1486 PSF, which is sub-$1500 PSF. So really good profit. It made $336,000 which is by far the highest annualized returns at 5.1 percent. This is in line with what we mentioned in our predictions video for 2021, where we have a strong conviction that large units in the OCR will outperform their investment moving forward. We have shared plenty of data in the past to illustrate this fact, and this is just another example to show you. That was the guy that made the most money, so moving on to the second one, which is 667 square feet. I’m highlighted this one because the PSF sold was $1700. When we saw this, we also got a big shock, but he bought it very expensive, with his 1438 PSF versus 1265 PSF for the 4-bedroom and ours at 1280 PSF? Why is his so much higher? We will elaborate a little bit further on that later as well.

When we look down to the transaction on 4th September 2020, it was for 926 square feet. Our first choice was actually 926 square feet, which is a 3-bedroom compact. Later we will show you how close the prices were, which actually made it sensible to get the 3-bedroom compact, but based on how it has performed, we were lucky that our turn was very late in the day, so all the 3-bedroom complex were actually sold out and we had no choice but to buy our stack. All things turned out well and we ended up outperforming them in terms of profit. I highlighted all the comparable units to ours here and this turns out to be, basically, the 3-bedroom complexes at 926 square feet. Notice that they all bought in around $1000 PSF. Conventional wisdom will say that the larger units would usually have a lower PSF than the smaller units but notice how we had an entry price of around $1200 and they had an entry price of $1400, and this could be the main reason why they didn’t make as much of a profit as us. So why is this so?

This is the floor plan and the transaction log for the 4-bedroom unit, just for your reference. One of the points we wanted to highlight was that if you notice when they bought, they actually bought it a year after launch. It’s not necessary to buy at launch to make a profit, where we serve as a case in point, having bought a year after launch and still making very good profits.

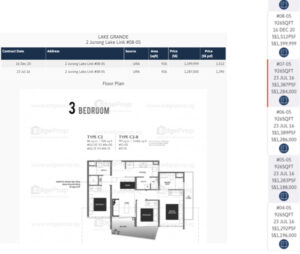

This is the 3-bedroom and if you study the floor plan, it is a really good layout because this is a 3-bedroom compact with an enclosed kitchen. It can be converted into a dual-key because one of the bedrooms is tucked all the way on one side of the unit with an attached toilet. Our intention entering in as an investor was to convert it into a dual key lock for higher rental yield if we had actually gotten the unit. However, everything turned out to work in our favour as we couldn’t get the unit. Notice that the units sold were above level 8. Why is that? I’m going to jump straight into the site plan.

This is the 3-bedroom and if you study the floor plan, it is a really good layout because this is a 3-bedroom compact with an enclosed kitchen. It can be converted into a dual-key because one of the bedrooms is tucked all the way on one side of the unit with an attached toilet. Our intention entering in as an investor was to convert it into a dual key lock for higher rental yield if we had actually gotten the unit. However, everything turned out to work in our favour as we couldn’t get the unit. Notice that the units sold were above level 8. Why is that? I’m going to jump straight into the site plan.

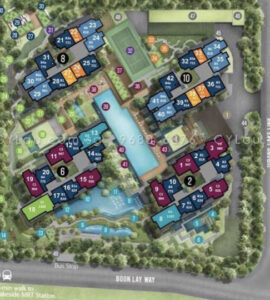

If you look at the bottom of the plan, Block 2 and Block 6 are across Boon Lay Way. There was a significant price jump from Level 5 to Level 6, it being $100,000 increase for the exact same unit because at level 5 you are on level with the MRT track and Level 6 you clear the MRT track.

It’s a significant price gap, so when we saw this price, we actually told ourselves that if the units were above level 5, it didn’t make sense buying them anymore because of the significant loading and then that price difference. A Level 8 unit, as you can see here, was sold at $1.287 Million. The price gap is very different from our purchase, at $1.1 million and a Level 5 unit which was sold at $1.18 million.

This was just 80,000 more than what we bought that. This is something that we talked about also in a lot of our sharings, that it’s important to look at the price gaps between the different unit types that you are buying. If the unit is a 2-bedroom plus study and the gap to a proper full 3-bedroom is just $80,000, ideally you pick the bigger unit. Our threshold for this gap at that point in time was $100,000 difference.

Bearing in mind that the lower floor units were going at a significantly lower price, we didn’t want to go for the higher floor unit. So, we dropped down to the to the 2-bedroom plus study. We now want to share some of the things that we learned to serve as learning points. We purchased Stack 29 at the back, which isn’t a lake-facing unit.

We actually chose a unit that also didn’t face the pool, which was why our PSF is so much lower than the PSF for the units that were facing the lake, so this is a great learning point.

Now that we are talking about Lake Grande, I thought I could take this opportunity to use this as a case-study for resale and new launch price performance. Over at the Lakeside area, some of the comparable existing condos when we bought were Caspian, The Lakeshore and Park Oasis. When we bought Lake Grande at 1280 PSF, Park Oasis, Caspian and The Lakeshore were averaging around the $1000 PSF so there was a good $200 PSF differential. Today, Lake Grand has moved up to $1500 to $1600 and even $1700, as the 667 square feet unit sells at $1700 PSF.

But The Lakeshore Park Oasis and Caspian are still hovering at that $1000 PSF range, so it’s one of a good case study on the outperforming of new launches compared to existing properties. We will not dive into great detail here on why that is happening, but if you are keen to find out, you can drop us a text. Similarly, we have also laid in other big developments over in the west side of Singapore. We have included Park Riviera and The Centrus and you will notice that the new launches are outperforming the existing developments.

In summary, what did we learn from our experience over at Lake Grand? The timing of the exit matters. If we refer back to the transaction report for Lake Grande, notice that the unit that was sold at 2018 and the unit that was sold in early 2020, both did not perform as well as us.

As a matter of fact, we actually exited a little bit earlier than them. So why was it a good time to exit? Referring to the TOP supply graph, this one. We knew that it would be a good time to sell when the TOP supply is low. Hopefully this makes sense to all of you.

Why would somebody be paying $1500, 1600 or 1700 PSF for a new development when the existing development is at $1000 or 1100 PSF? Once we have TOP, we are both the same. As soon as you pay, you can collect here and then move in. Obviously, the preference for buyers in that area is for newer properties and they are willing to pay a significant premium for that because they have no choice, as the TOP supply is so low. Coming back to the points that we learned, timing matters in an exit. If you exit at a time with high TOP supply, you probably wouldn’t be able to charge such a significant premium over your peers because of competition.

Next learning point is that layout matters. we picked a layout with an enclosed kitchen. If you look for the layout, you know it’s a 2-bedroom plus study with enclosed kitchen. The next thing to note is the buyer profile. Who were our buyers? We only have 3 viewings for our particular unit, and we sold it with tenancy. We just entered our two-year tenancy and so the buyer has had to wait 1 and a 1/2 years to take possession of the of the of the of the unit. The buyer wanted it so much, because of the good school in the vicinity, we had Rulang Primary school within 1km.

For those of you who do not stay in the West, you probably have never heard of Rulang Primary, but Rulang Primary basically brought us the profit, so a good primary school in the vicinity is a major plus. Our buyer was pregnant and wanted to buy the unit to put their kid into Rulang Primary in the future. They planned it for their own stay, which was why the enclosed kitchen mattered. These were some of the points that we gathered from the wholesale process.

The last point is to be aware of the premium facing premiums. What does that mean? Remember when I showed you that the lake facing units, were being charged by the developers at $1400 PSF while we were able to buy a $1280 PSF.

At the end of the day, in the resale market, you’ve got to ask yourself what are the buyers buying in that area for? We realised and knew that they would be buying the units for the upside potential, had the high-speed rail came into fruition. They were buying it for the schools. Are they really buying it for the lake view? We didn’t know, but we were leaning more towards a “No” because it was also facing the MRT and is also facing the road. We didn’t feel that buyers will pay that premium and our expectation turn out to be right.

Developers may price it a certain way and you have to be aware. When they price it more expensively, eventually you’ll start to think that it is premium and you can charge a premium, which actually is true, but the premium shrinks. As you can see from the transactions, it shrunk from $200 PSF to just $100 PSF. So basically, the people that bought at $1200 PSF made more.

Our Property Plan: The Present

Today, we own Parc Esta. We have bought a 3-bedroom premium and we bought it during February 2020, right before the Circuit Breaker. We bought it at $1.72 million for 1033 square feet and premium means it comes with a utility room.

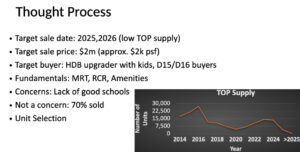

What was the top process behind the purchase at Park Esta? I will explain a little bit on how we narrowed down of all the launches to Park Esta later on, but first we will explain the whole plan that we have set for Park Esta. You can use this template for yourself actually and it’s very useful.

When is our target sale date?

We have targeted it to sell in 2025 to 2026. We want to sell in periods of low TOP, as we’ve learned it once, we’re going to replicate the end of it again, and because you are listening, you can use it too.

What is our target sale price?

we are targeting at $2 million, so if it doesn’t hit $2 million, we’re just going to continue to hold it because we are confident that it will eventually hit that mark. After all, since the Pasir Ris 2-bedroom unit is already worth 1.5 million, there’s no reason why a property in Eunos cannot hit $2000 PSF.

Who are our target buyers?

Ideally, we are selling to upwardly mobile HDB upgraders, probably coming from Tampines, Sengkang or Punggol. Some upgraders are focusing on size, but there are also, group of upgraders that want to upgrade in terms of location, as they want to upgrade closer to the city centre. This is the group that we are targeting, and we’ve got a 3-bedroom premium because it is likely they have kids, so they would need the premium. They probably have a helper, and are likely to be high-earning, dual-income households, in our 13.9 percent group making 20K and above.

With $20,000 and above in combined household, we have calculated that they can their budget of purchase can go all the way up to $3.3 million if they want to, so $2 million is absolute bargain for them.

Another group of buyers will be the D15, D-16 owners who are helping their kids buy a property nearby, so that they can continue to stay in close proximity to the parents or the kids that want to buy to stay in close proximity to their parents.

As we all know, D15, D-16 owners have the capacity to either assist their kids to make this purchase or the kids have the financial capacity to make this purchase on that one.

What are some of the fundamentals that we have applied in selecting Park Esta?

It is near and basically besides the MRT, and is located in the RCR, feeding into the fact that we are targeting HDB Upgraders that are looking to upgrade in terms of location. We know that it is not a huge unit, it’s a similar size as a 4-room HDB, but that’s not the group that we are targeting. The groups that are upgrading for size, are not really the group that we are that we are targeting. There are excellent amenities as well. We are very focused on selling to owner-occupiers, people that are buying it to occupy the unit for themselves and we will explain why soon.

We’ve said it before, ideally you would like to sell to people that buy for their own stay, because there’s going to be an emotional attachment involved and with that emotional attachment involved, they’re more willing to pay. If you really like something you would pay for it, versus investors selling it to investors where they are very focused in terms of getting the right entry price and driving a good bargain.

One of the concerns that we had was the lack of good schools nearby, and there’s no good school within 1km of Park Esta. We weren’t able to tap on the fundamental that helped us reap the reasonable returns from Lake Grande.

We had to weigh the pros and cons and we’re comfortable without the good schools nearby. Another thing that you need to do is to be realistic. I think a lot of the times people are overly optimistic or have basically too many or too unrealistic of a requirement and in the end, they are unable to find anything as nothing that can take all the boxes. There’s nothing out there that’s going to tick all the boxes, so you have to weigh the pros and the cons and come to an informed decision.

So, what was not a concern?

So, the concern was a lack of good school, but what was then not a concern was the fact that it was 70 percent sold through. For those who follow and know us, we are fundamentals-based buyers that do not subscribe to the whole FOMO (fear of missing out) mentality. Even though we bought Lake Grande on day one, we don’t see a need to buy on day one.

Fundamentally, the project has to make sense. First and foremost, your entry time and your entry price have to make sense. The buying, be it on day one, one year later, two years later, if the fundamentals make sense, doesn’t really concern us. We feel like a lot of people are now stuck in the in the middle because conventional wisdom tells you that you buy a unit on day one and it gives you the highest chance to make a profit.

The fact is that the supply coming on the market would be the supply with the future price and the supply that was that is currently in the market which is based on the old price. The fact is that these days, you have bought in at an estimated 80-90 percent at any development is likely.

Which one gives you the best value proposition?

Our answer is look at the fundamentals. Look at your own plans and do your own research. Don’t just subscribe to the whole theory that you got to buy day one. So, case in point, the person that bought the 2-bedroom at $2000 PSF, $400,000 more expensive than the person that bought in day one, over at Pair RIs. I feel that it’s going to be quite challenging for him to yield good profits from deadline.

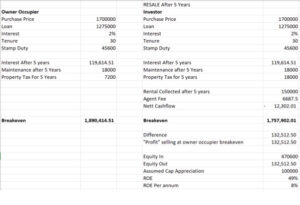

In this next part, let’s go onto the unit selection. I think that’s also something interesting for us to share. We bought we bought Stack 12 for our purchase price of $1.72 million. Then there is this other unit that is in Stack 4. It is 10 square feet smaller, measuring at 1023 square feet, and transacted at $1.6. Million, but it’s the same unit.

Basically, the same layout, with just a different facing. But the difference in price is $120,000 so we thought we would talk a little bit about this because it’s very different. Remember, in Lake Grand we bought the cheaper PSF, and we didn’t buy into the developer’s loading, but in in Parc Esta, we bought the $120,000 more expensive unit.

So why? What’s the thought process? Most investors would tell you to just buy the lowest PSF or the lowest entry price. When we wanted to buy it, we tried to wear the hat of the buyers that would buy from us in the future. We also thought about moving in to stay for a little while, so we wanted to experience living in the unit for ourselves.

Things like what the noise level of the unit was at stack 4, facing the road, were important factors that we wanted to consider. We did actual groundwork and walked the ground which helped us realise that the noise level for Stack 4, facing the road, would be significantly louder than the unit that would be facing the inside instead. We then asked ourselves if this kind of noise would be acceptable if we were to stay in the unit ourselves.

Remember, we had decided we would focus on selling to owner occupiers. If we were purchasing the unit as an investor, we would have picked Stack 4 easily as we would have constantly just been renting it out. A unit facing the road is not an issue if you are just renting but if somebody is going to pay you $1.8 to 1.92 million for a 3-bedroom premium, they would choose to take the time to do groundwork and see the actual unit.

So, this is probably serves as another learning point. When most people buy a new launch, they base it solely on the floor plan or solely on the PSF. But when you sell out on the resale market, that buyer is going to come in and view all the units in the in the development and make that decision by basically opening the doors and listening to the sounds.

The buyer is already willing to pay and remember paying for their own property to stay in has a lot of emotions involved. That person would be more likely to pay $120,000 more, just to face the inside.

Moving onto the next point, we wanted to buy into a stack that was primarily owner-occupied. We based this decision of the analysis above. It is an analysis that we do which basically measures the breakeven price of a unit if it’s owner-occupied versus the breakeven price of a unit that is out on rent. You might that for the $1.7 million purchase, the breakeven price for owner occupied units are $1.89 million.

For investor-occupied unit that would be out on rent, the breakeven price is only $1.75 million. We also bought the inward facing stack because there’s a very good chance that the bulk of the buyers that are buying that stack are owner-occupiers, which is the only reason why they were paid at that premium. They will all have to be pricing their units at $1.9 to 2 million.

If we do put it on rental, our breakeven is only going to be 1.75 million five years after TOP. And that’s going to put us at a significant price advantage over our neighbours. We will use them to basically pull our prices up.

What is our contingency plan? This is something that we want to talk about as well, because there are different types of fear, such as a rational fear and also an irrational fear. A lot of the irrational fear with a big property purchase, comes about from the fact that people feel that it’s going to be an extremely long-term investment and you’re locking yourself into a long-term, 30-year mortgage. They get scared off because they feel they will become a slave to their houses for the next 30 years. We beg to differ. What’s the worst that could happen?

We are seeing this from our own perspective where if things don’t go well, we can very easily rent it out and find somewhere cheaper to stay and use the difference in terms of the rental to just pay off the interest payments, at least.

That’s the contingency plan. If anything happens, we keep the CPF For an emergency fund and that emergency fund is sufficient to pay the mortgage for a year if anything were to happen. By staggering and putting your contingency plan in a very clear and concise manner, it reduces the fear from being an irrational fear to a more rational fear. If anything were to happen if we were to go through the emergency fund after a year, nobody will cling onto the property. If you lose your job for six months or a year, you’re going to start thinking about selling your property and right-sizing, so you won’t go broke paying your mortgage.

All you have to do is if you can’t pay off the mortgage anymore is to sell the property and right-size and get yourself out of that difficult situation. There are always going to be contingency plans and there are always ways to get around these positions. We don’t see the mortgage as a 30-year mortgage precisely because we intend to flip it. Yeah, yeah so. Manage and understand your fear, so you can bring it from an irrational fear to a rational fear with clear and concise contingency plans, preferably with actual figures in it.

Our Property Plan: The Future

We’ve talked about the past. We’ve talked about the present. So, what is the future? We are working hard to achieve our goal, which would be a semi-detached in the future. Don’t be afraid to dream and don’t be afraid to have targets in mind.

Work your property plan towards that long-term target in mind and then you work backwards from the goal to try to achieve it. Aa lot of the times what people do is they just take one step at a time and focusing on their current needs and requirements and then leaving the ability to be able to reach their final goal to chance. You don’t have to do that. Work your way backwards and the main thing is to focus on the intermediate steps.

First of all, the plan will become a lot clearer, and secondly, you prevent yourself from making decisions that you will come to regret later.

Let’s now talk about how we plan. The concept of delayed gratification, so it’s something that we really use for ourselves. It’s very clear what our long-term goal is, and we are willing to take the necessary steps and the necessary troubles, all these in-between steps to hit that that goal.

Thankfully, we’ve seen more families, clients and couples choose to take this step, and accept delayed gratification to live with a little bit of inconvenience so they can hit their goal in the future which was not the case 5 years ago. This is really why we wanted to do our upfront and transparent sharing, because we wanted to put it out there and share that you should always have a dream, dare to make goals and have that long term plan.

Here are some of the tips to plan your property purchases. Have long term goals in mind is very important, don’t be afraid to dream, especially if you know your earning power is going to rise up or you’re expecting to hit new earning potential.

A painful thing that we notice with a lot of clients is that when we speak to them, their income and their purchasing power have come up, but they are stuck in the property that is difficult to sell or they don’t want to sell because if they sold, they would have to make a loss. This makes the whole situation focused on emotions and feeling rather than logic and reasoning.

So, always have long term plans. Work backwards so you don’t do something that you regret, and you’ll always be able to keep yourself on track to hit your goals. From there, you can build a very systematic plan, using the template that we have provided earlier. Set clear targets and goals for when you are looking to sell, how much you’re looking to sell and who you’re going to be selling to. Our next tip is to consider logic and emotions.

Logic & Emotions

Logic is very straightforward.

Logic is facts and figures, research knowledge, etc. You are already doing a good job on that aspect, if you are listening to our content. Knowledge is the antidote to fear and the more knowledge you have, the less fear you have and the more knowledge you have, the more clarity you have. emotions, mindsets, and communication are all actually more important than the logic and reasoning.

This is something that we constantly tell our clients. Data and sharings about the information are very, very common in the market at this point in time, if you were to go to YouTube, you would find tons of videos, sharing, reviews and market knowledge. We choose to do this is because we are talking about topics that are not discussed as much, in the public forums, which is the mindset and emotions part of a property purchase as an investment. We talk about things like delayed gratification, long-term plans, daring to dream, working your way backwards, having their systematic plan involved.

Having all of that reduces the emotional factor that actually impairs and prevents a lot of people from making very good and logical property purchasing decisions, so the mindset has to be correct in order to make the right choices. A big fear that we have today are overly aggressive strategies. Even though we are planning to exit during 2025 or 2026, if that is not a right time, we are perfectly able to hold it and to manage around it. Similarly with Lake Grande, if the prices were not right, we wouldn’t have sold it and would have been perfectly comfortable continuing to hold it.

I have spoken to a lot of people that have made very drastic bets into the property. They basically have a huge bet and hope that it would turn out well in in 3 to 4 years. We honestly wouldn’t recommend that way of doing things. Property is not the most liquid of investments, so it’s always good to have the right mindset entering a property purchase. Anything shorter and it’s a bonus but you should be more than happy to go in the long-term. Communication between you and your partner or you and the other stakeholders in this property purchase, is very important. It is always good to have a common goal in mind. For those of you who have trouble agreeing with your spouse or your partner on what is this next purchase, a good suggestion is then just put yourself into a more macro-perspective. Take a look at the long-term goal and make sure you can agree on that.

It is probably a lot easier to agree upon a long-term goal than the short-term goal. Agree on the long-term goal and then work backwards yourselves. It has helped our clients gain a lot of clarity and be really able to have that property plan in place to take action. Communicate on your goals on your plan or your long-term goals. If you are having trouble with that, you can reach out to us. We have clients that say we end up acting like a counsellor to bring the needs and requirements together.